Property life and tech in a post pandemic 2022

Pandemic throwback, the world we knew, joyful, very social, and with a conducive property market, suddenly disappeared in March 2020 and the 2020 year’s end, because of it, will be remembered as the least happening of the past 100 years, or more.

No big parties and celebrations and not many fireworks either. In general, a cautious and “socially distanced” approach towards the New Year, together with a fear that the property market might be crashing soon if a new surge of the pandemic kicks in!

By looking at what Covid-19 has caused to the world, we are definitely witnessing something unprecedented in humankind's history! It is the first time a worldwide pandemic is causing such a brutal and sudden disruption to our lives, the way they used to be. The world actually experienced a similar widespread pandemic before!

It was the year 1918 World War 1 almost at its end when the “Spanish Flu” hit with its first wave. Three more waves came in the following two years and the final numbers of this pandemic of the past century totaled 500 million people infected, with estimated deaths of between 24.7 and 39.3 million according to the word-in-data website.

Numbers are impressive but we need to keep in mind what the world did not have at that time. World Health Organisation (UN), internet, advanced pharmaceutical R&D centres, a widely interactive researcher network and many more were not available and would have contributed in reducing tremendously the impact of the Spanish Flu Pandemic!

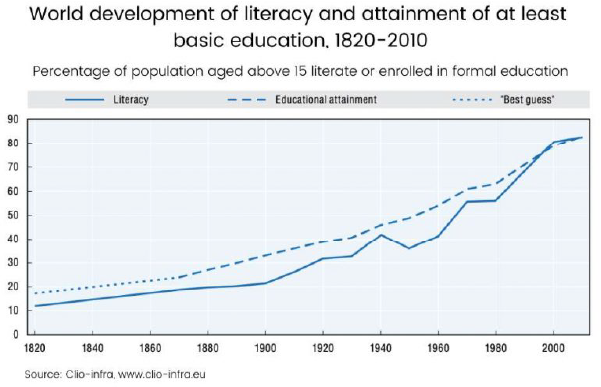

Another huge difference comes from the literacy rate and wealth distribution of the early years of the past century! Literacy was at a mere 30% of the world population (as a comparison we are now at almost at 90%) while the world poverty rate was at a stunning 75%, whereby we are now at 10% (percentages are calculated on the world population and represent the ones living in extreme poverty).

No internet to fast communicate SOPs and news about the pandemic, no education to even read the news, no wealth, money, to even take basic protection tools/measures. In other words, we can assume that the Covid-19 pandemic, which has affected more than 260 million people with a death count up to 5.2 million as at November 30, 2021 (data sourced from WHO website), has been by far worse than the Spanish Flu!

The New Normal

Since its beginning, this pandemic has deeply affected our way of living, working, studying, traveling, socialising, and more!

Since its beginning, this pandemic has deeply affected our way of living, working, studying, traveling, socialising, and more!

The world’s social lifestyle has dramatically changed and so did businesses.

In Malaysia, as of July 2021, almost 70% of the professional workforce has embraced, some joyful and some concerns, the WFH (Work From Home) mode.

The tourism industry is at a dramatic turning point, and F&B has been re-invented, leveraging e-commerce to bring the dine-in experience to your doorstep with takeaway lunches and dinners. Entertainment outlets and event organisers are re-looking into their business models and becoming more creative using virtual and 3D technologies.

Schools have been closed to physical classes most of the time for the past two years, and e-learning has been taking the lead! And the list of radical changes brought in by the pandemic can go on.

The pandemic, with all its restrictions and new rules of socialising, has been pushing humankind towards a much faster adoption of digital transformation and we all have been realising that physical meetings are more expensive and time-consuming if compared to virtual ones! Not to mention the huge cost reduction for SMEs adopting the WFH trend and, last but not least, the reduced frequency of traffic jams with related accidents and fatalities.

In conclusion, we all have experienced a dramatic and fast change of how we were working and carrying on our daily lives and there is not going to be a “return to the old normal”. So better get ready and understand how to adapt faster and leverage on the future!

Forthcoming Future, the Recovery After The Pandemic

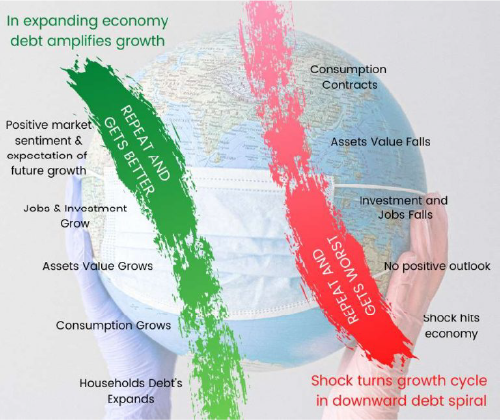

Which type of future is we are looking at, what is the scenario we should be getting ready for? Many experts, and unfortunately, I agree with them, are foreseeing the need for at least one more year before a full recovery will take place and, on a global scene, several researchers are saying: Covid-19 pandemic represents the end of globalisation the way we knew it, and it has acted as main shock factor at a global level!

Healing economy

Malaysia’s gross domestic product (GDP), badly affected during the first half of 2021 by all the movement restrictions and the full closure for a few months of physical offices, is now hopefully poised for a recovery. No doubt, the expected growth of between 6.5% and 7.5% for this year is now a sad fairy tale.

We will be lucky to see a mere 3% to a max 4% by December 2021 and we will all need to run to achieve it! However, it has to be noted that as soon as the economy starts being re-opened in October 2021, everything that was stalling or undecided and definitely not in the movement started running.

Maybe there will be a surprise and, for sure, in 2022 the result should be much better. I’m personally looking for at least a 7% to 7.5% growth for the next year. US-China trade-war-going-to peace and the recently signed Regional Comprehensive Economic Partnership agreement (RCEP) will lead the strong regional recovery, and Malaysia, supported by infrastructure, financial stability, and geographic location, should definitely gain from this process.

Healing businesses

The disruption caused by the pandemic doesn’t mean endgame, it should be looked at as a strong push to change and innovate! The whole world, after attending countless conferences and forums I’m definitely sure about this, is learning the lesson and applying a new way of looking at business and the future after the pandemic!

Future of people, business, and property, of course. Hopefully, the government will support this radical change, the disruptive WFH and innovative wave by ensuring that Malaysia will be in the short term future-ready in terms of “soft infrastructure” adequate to the current speed, accelerated by the pandemic, of our digital transformation.

Healing Of Property: A New And Different Market

The property industry, which was already suffering from a high “unsold stock” before the pandemic kicked in, has definitely taken a bad hit!

The Covid-19 pandemic has contributed to worsening the property market perception about “investment”, specifically property investing or buying, resulting in a negative result for the past almost two years!

However, being able to look at all the above happenings with a positive eye, the current global situation is presenting, to all of us, “the greatest opportunities of the past 100 years”!

Let’s go together through the main trends detected in the property market to get where, in the months to come, the best opportunities for property hunters will be. To get ready for the future, we must first analyse the past!

Property Pain Points From The Past: The Pre-pandemic

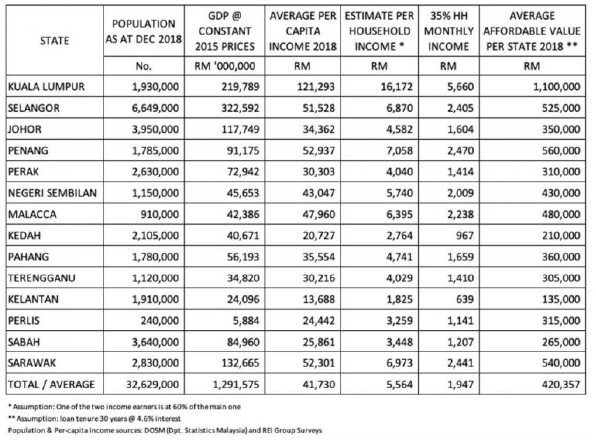

The residential market in Malaysia, since the beginning of 2019, has been showing a growing demand toward both landed and high-rise properties priced below RM700,000 (USD175,000), for some areas of Malaysia, the value to be looked at is RM400,000 (USD100,000).

City center properties, not only in Kuala Lumpur, have been left aside, by potential buyers, due to the high cost per square foot, sizes either too big or too small and, above all, due to the huge unsold stock which, combined with low occupancy rates (untenanted units), clearly shows a substantial oversupply situation.

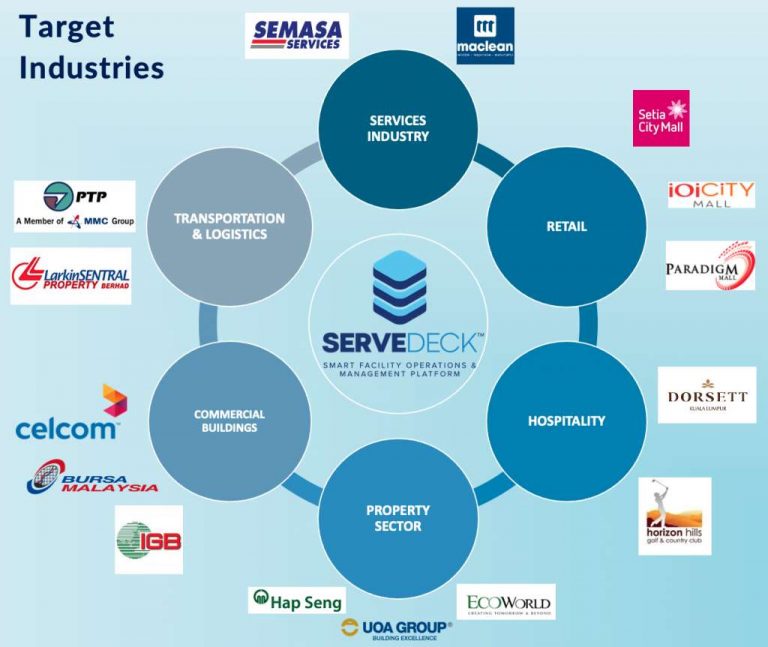

Office market will need to be partially re-invented. The building owner will have to improve the quality of their facility management by adopting good “cost-saving” digital tools, such as ServeDeck, to increase efficiency while controlling their costs. Office space is still in demand and hopefully, now that the borders are re-opening, foreigners will return and contribute again to fill up some of the unoccupied space.

The retail industry and its related properties have been badly disrupted by the huge growth of e-commerce during the past two years. The future of shopping malls might be seeing a rise of “experience creation” to attract more crowds, retailers might be transforming their shops into “touch & feel” or “try & look” experiences for their customers, who will then choose off-line and buy on-line. This future re-engineering of the retail industry will involve logistic and warehousing (last mile challenge) solutions.

Resorts and hotels in Malaysia as well as in the whole world, were already under pressure before the pandemic, in the past 24 months the tourism industry has been suffering the most and we all witnessed the disappearance of a great number of well-known hotel brands.

Malaysia has not yet been able to become sexy and appealing enough to attract more “returning” and “long-term” tourists. In the post-pandemic era, tourism industry stakeholders will need to find different ways to attract both domestic and international tourism and offer different experiences to their clients.

Loan approvals for properties have been at the lowest for a long now, with most of the few approved mortgages, far below the previously commonly granted 90% margin of financing.

The Budget 2022, looked at as a boosting game-changer by property stakeholders before its announcement, has deluded all expectations as it focused more on the economic relaunch, digital transformation of businesses at large, and workers' up-skilling. Hopefully, these focuses will bring in a much-needed purchasing power increase in both B40 and M40.

The Covid-19 Pandemic Variable in the Property Market!

Then, Covid-19, the pandemic, stricken, causing the Great Lockdown to kick in and social distancing and WFH to become part of our “New Normal” lives!

From a residential point of view, the demand for bigger spaces, at least from the 70% of Malaysian professionals adopting the WFH mode, is on the rise as far as the “expansion” of the search range for properties to sub-urban and beyond areas.

Furthermore, data from NAPIC are confirming that the supply (for values below RM700k) is still behind the potential demand when compared with demographic data (check these two tables comparing existing stock of properties with a total number of households and you will get it).

Families currently living in limited spaces, below 700 sq.ft., are searching for bigger properties where a wider space or even a dedicated room could be allocated to “WFH-area”.

The “sexy-of-the-past” studio unit might not anymore be as popular a property as it was in the past, and, even worst, it will not be possible to recycle it into AIRBNB or short-staying tourists. Tourist arrivals are still and will remain for quite some time a fairy tale thanks to the pandemic!

The so popular TOD (Transit Oriented Development), small studio units within high-density buildings incorporating a public transportation station, might be left empty with the “WFH mode, so I need more space” being the killer once more.

In general, we can expect the past property “up-zoning” trend (high density within urban areas) to move towards “down-zoning” (low-density development, low-rise or landed properties, and away from city centers).

Property primary market still offers a great opportunity, and more will come our way in the forthcoming future. The Malaysian Property Market will definitely recover, rise and shine as never before, but it might be taking a while.

In the meantime, we better get ready to grab the good opportunities which will come our way following the table below for the “buy” or “don’t buy” decision.

Hot spots wise, Greater KL, its sub-urban, and beyond areas still remain a good choice. For better understanding, the beyond covering the “West and South Corridors of Klang Valley” respectively till Port Klang and Seremban.

Johor Bahru and Iskandar Malaysia, property-wise, are still representing a good buy providing the investor, during these trying times, has good holding power. A comparative parallel with Shenzhen in China shows that, eventually, it will happen. It is just a matter of keeping in mind that Shenzhen was launched in the middle 80s and it has taken more than 30 years to become an “economic region and property” success story.

Penang, Malacca, Kota Kinabalu, and Sarawak are also still good destinations for property investors, providing a due diligence is done on the market trend and related demand, which are very different location-wise and for sure considering the “long wave effect” of the current pandemic.

To be kept in mind, while doing the due diligence on a possible property investment, to always double confirm all the given information by the sales representative to make sure everything is correct!

The upcoming star in the property investment panorama is Kuantan. Main city and commercial harbor of the east coast of Malaysia, Kuantan, is raising its attraction due to the upcoming ECRL (East Coast Rail Line) and all the happening in terms of industrial park developments, driven by the ECER (East Coast Economic Region) planning.

Some very interesting townships have been and are growing with property developers delivering products that for once, are demand driven! Worth paying a visit!

What will happen with all those millions of empty property square feet from office, hospitality, and, eventually, retail then? Recycling and reusing will be the passwords!

Malaysia has still a substantial shortfall of affordable housing, and empty office and hospitality space might be partially re-developed to address this demand. It is a medium-term game, but it could be working. Another very interesting niche of the property market that few have been looking at, is the fast-growing group of aging Malaysians.

In the next 20 years, the “third age group” (people aged 65 years and above) will almost double while the natural growth rate for Malaysia will keep on remaining stable. The result is, higher demand for “residential-cum-medical-care-services” properties, and several resorts and hospitality designed building, would be perfect to address this demand.

How Technology Could Help Re-booting The Property Market

A positive change that is slowly happening, mostly helped by the pandemic, is the shift towards a full digital transformation that many developers and property professionals are and will be adopting. Malaysia PropTech Association, the industry hub for plenty of PropTech solutions, has seen its membership growing at a much faster pace and all members have been reporting faster growth of their own market share.

All this means technology is really entering in all layers of our built environment, helping all main stakeholders and players to keep the ball rolling first and thriving later.

ServeDeck, an interesting all-in-one facility and operation, digital solution which has seen its business being boosted by the pandemic, has been keeping on serving its clients even during the strictest MCOs (movement control orders) and has expanded its reach beyond Malaysia.

Bringing manual facility management towards an all-in-one platform carries the great advantage of having all information available on a centralised dashboard, collecting data on all the different assets and equipment in the specific building and managing time, emergencies and people in a very efficient manner.

A better organised and well-run building will generate higher efficiency of all its components, and finally, tenants' satisfaction will be much higher. A great advantage of this transformational adoption is that, at the end, operational costs will be moving downward while satisfaction and efficiency will be up to unprecedented heights.

Check out ServeDeck all-in-one facility and operation, digital solution here and get in touch with our “ServeDeck Customers’ Experience Team” to know more and set a date for a demo.

Besides ServeDeck, many more are Proptech start-ups offering innovative solutions to the market and finally making the whole property industry healthier and safer. Check out the Malaysia Proptech Association website here!

Stay tuned to our blog very soon there will be a series of PropTech related articles that our Propenomist is preparing for our readers.

In conclusion, Malaysia has and is surviving the “2020-21 Perfect Pandemic Storm” pretty well. We know when it started, but cannot foresee, for the moment, when it will finally end. However, as all the storms do, it will end, and the sun will shine again better than before!

The above are just some ideas or thinking points for the readers about the property, the pandemic, and the future. If you have more arguments, agree or eventually disagree, and want to reach the author, he will reply to your comments.

ABOUT THE AUTHOR

.jpeg)

The opinions expressed in this article are solely of the author, Dr Daniele Gambero.

Dr Gambero has been an expatriate to Malaysia from Italy, since 1998 and has more than 35 years of real estate experience. He is the co-founder and group CEO of REI Group of Companies, the Co-founder of Propenomy.com and the deputy president of the Malaysia Proptech Association.

In the past 10 years Daniele, as international and TEDX speaker, has engaged several hundreds thousand people talking about Property, Economy, Propenomy, Digital Marketing and Motivation. He is also a bestselling author and columnist on several magazines and main stream media. You can reach him directly through his LinkedIn page here.

SHARE THIS POST:

Comments (2)

Leave a Reply

Your email address will not be published. Required fields are marked *